Vietnam CSP

Provide Feedback

CloseShare With Contacts

CloseShare With Contacts

CloseCopy Link

Closehttps://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Delete Message?

Are you sure you want to delete this message?

An update is now available for this app!

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

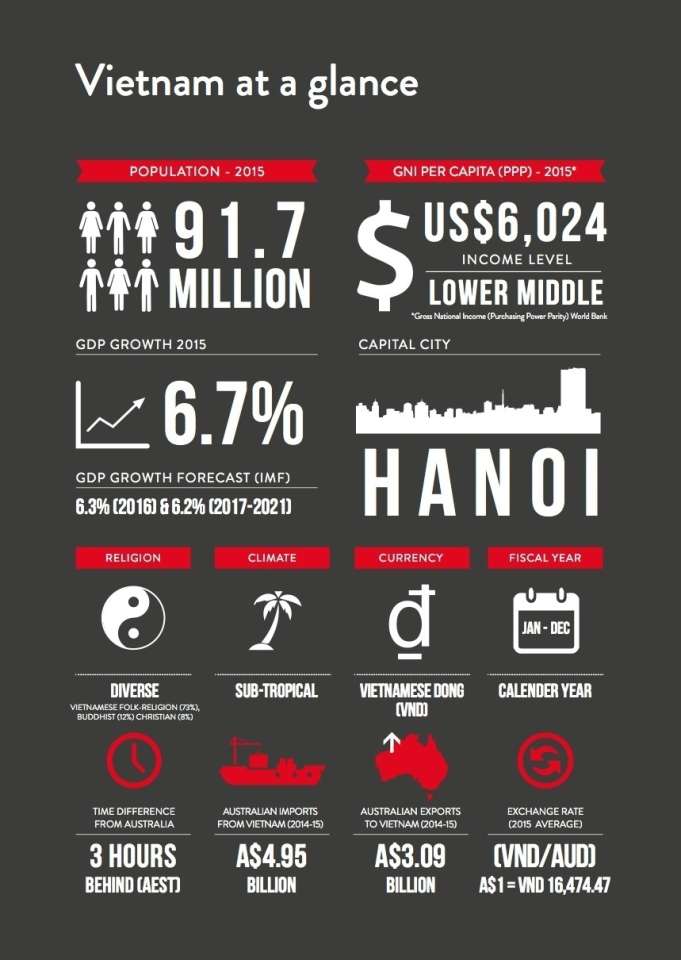

Vietnam is one of Asia's great economic success stories of the past 30 years. Since economic reforms were implemented from 1986, Vietnam has experienced unprecedented economic growth, with an average annual increase in GDP of 6.4 per cent. With a young and energetic population, it is expected to remain among the world's fastest growing economies over the next decade.

As the Vietnamese Government continues to make the country an easier place to do business and encourage private enterprise, there has never been a better time for Australian companies to consider doing business there. Consider:

Vietnam is one of four ASEAN nations that have signed the Trans-Pacific Partnership aimed at removing 98 per cent of tariffs in the TPP region.

Thanks to cost-competitive labour, improving infrastructure and international trade links, it has quickly established itself as the go-to destination for advanced manufacturing.

Economic growth in 2015 was almost six per cent.

One of the highest internet penetration rates in Southeast Asia.

Foreign direct investment up 12.5 per cent in 2015 to USD 22.76 billion (AUD 30 billion), making it an investment hub primed for growth.

Given the rapid economic transformation in Vietnam, it should not be surprising that trade between Australia and Vietnam is flourishing. Other positive factors include new regional trade deals and bilateral partnerships — including the ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) — that have lowered barriers and been a strong driver for growth in two-way trade in goods and services, worth more than AUD 10 billion annually.

Australian suppliers of energy, dairy products, meat, consumer goods, packaged food and beverages, wheat and machinery are particularly well placed. Growth in personal incomes has increased demand for education and training services in which Australia excels.

Australian suppliers also have quicker response times to market needs than suppliers from Europe and the USA, a particular advantage for food products. Australian businesses enjoy advantages in:

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

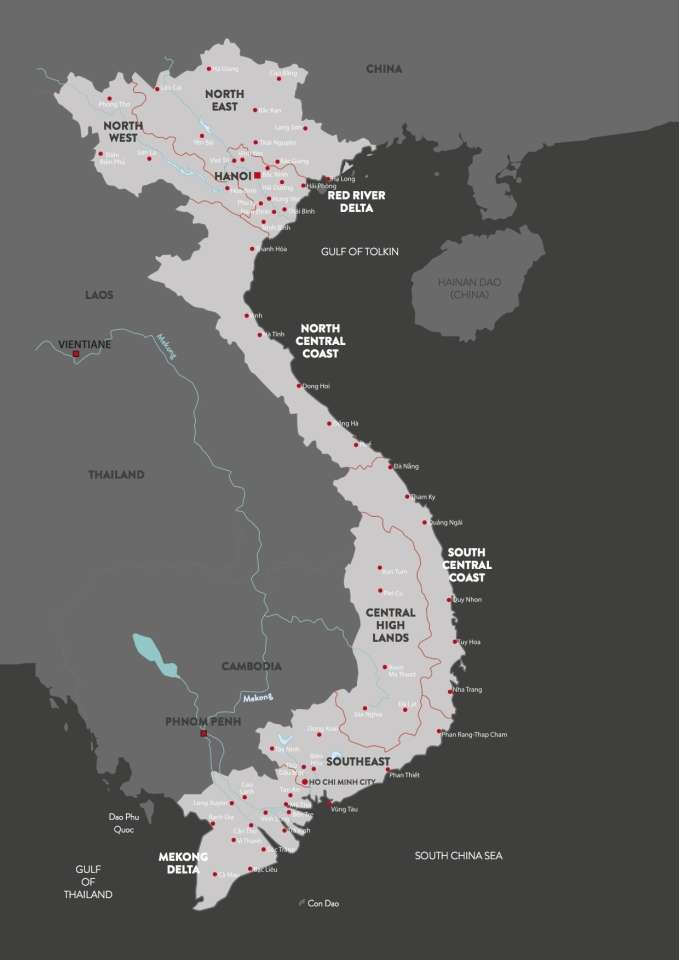

At 329,565 square kilometres, Vietnam has a land area almost the size of Germany. It shares land borders with China and Southeast Asian neighbours Laos and Cambodia. With 3,444 kilometres of coastline, Vietnam also borders the South China Sea and the Gulf of Thailand.

The capital Hanoi is in the mountainous north. Ho Chi Minh City, formerly Saigon, is in southern coastal lowlands near the vast Mekong Delta. The climate varies significantly between regions. The south has relatively stable temperatures and a tropical climate throughout the year. The north is sub-tropical and humid.

Between the first and sixth centuries AD, the region now known as Vietnam was controlled by the Cambodian Khmers in the south, the Chinese in the north, and the Hindu kingdom of Champa in the centre. It was not until the 11th to 13th centuries that Vietnam established an independent culture and its own rule.

Vietnam's modern-colonial history began with French military activity in 1847 in response to alleged Vietnamese suppression of Catholic missionaries. In 1925, Ho Chi Minh founded what became the Communist Party of Vietnam. Between 1945 and 1954, the United States provided billions of dollars in financial support to the French in their war against Vietnamese forces. After the French surrendered in 1954, Vietnam was temporarily divided between an anti-communist south and a communist north. By 1958, communist-led guerrillas known as the Viet Cong had begun to fight the South Vietnam government.

To support the south, the US initially sent in 2,000 military advisers. Their numbers grew to 16,300 in 1963. In 1965, after South Vietnam lost the Mekong Delta to the Viet Cong, US President Lyndon Johnson ordered air strikes on North Vietnam and committed ground forces, which by 1968 numbered more than 500,000. Australia was an active participant. Beginning in 1962 and ending in 1973, a total of 60,000 Australian personnel served there, with 512 killed and more than 3,000 wounded.

With the signing of the Paris Peace Accords in 1973, a total withdrawal of US forces was completed. The south collapsed in 1975 and formal unification of Vietnam followed in 1976.

Vietnamese culture is rich and diverse, drawing upon local heritage and increasingly from global trends. The country is dominated by the Kinh (Viet) ethnic grouping, which makes up roughly 85.7 per cent of the population. Another 53 ethnic groups make up the rest, among them Thais, Tays, Khmers and Muongs.

Confucianism is a critical part of interpersonal relations in Vietnam and determines multiple cultural norms. Respect for elders, husbands and family units underpin a culture that stresses harmony, duty, hierarchy, loyalty and family values.

A key part of Confucianism, the 'Five Great Relationships' underpins the hierarchical nature of relationships in Vietnam:

While the fifth signifies equality, the other four imply authority of one person over another. This framework is frequently visible in Vietnamese workplaces, households and societal systems. However, global influences are moderating these guidelines. Many religions are practised in Vietnam, though increasingly they, too, are waning. In the most recent available census data, 80.8 per cent of Vietnamese claimed to hold no religious beliefs.

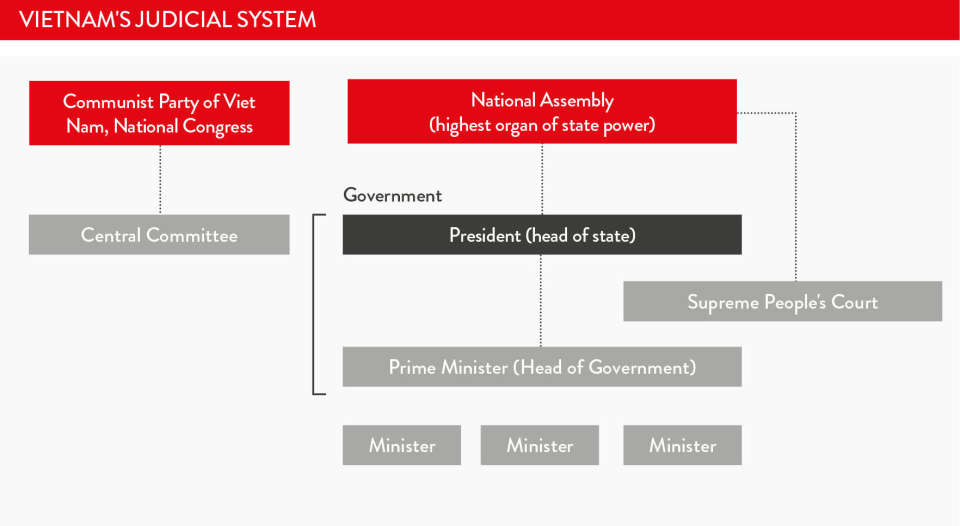

Vietnam is a one-party socialist state, governed by the Communist Party of Vietnam. A five-yearly National Party Congress chooses 175 full and 25 alternate members to sit on the powerful Central Committee that makes the main political decisions. The Central Committee elects a 16-person Politburo, which organises party affairs and makes decisions in between the bi-annual meeting of the Central Committee.

In parallel to the party, the National Assembly acts as a legislature, and debates and reviews legislation and policies proposed by the party — essentially providing a check on the Central Committee and Politburo. Its 500 members choose a President, who in turn selects the Prime Minister.

Vietnam's legal system is inherited from the French civil law system and has been influenced by socialist legal theory. The National Assembly is the highest office responsible for law making, assisted by Legal Committee and various subordinate offices. The Supreme People's Court is the highest court, made up of a chief justice and 13 other judges appointed by the President and National Assembly on five-year terms. Provincial and District People's Courts administer legal services at their appropriate levels.

Rapid economic growth since the early 1990s has helped Vietnam to lift more than 35 million people out of poverty. With average GDP per capita of USD 2,232, Vietnam achieved low middle-income status in 2015. Its economy is in transition from agrarian to industrialised. Vietnam has a young and increasingly affluent population of around 93 million, and is ideally situated to take advantage of regional economic progress.

However, Vietnam is still a developing country, and income disparities are pronounced. Agriculture remains a key source of national income and employs more than half the workforce. The manufacturing sector is dominated by a thriving textile and apparel export industry, with furniture and electronics also prominent. Many multinational technology and electronics companies have set up large-scale production facilities.

Vietnam's GDP growth of six per cent in 2015 exceeded both market expectations and its performances in the previous five years. Economic growth was tipped to again reach 6.4 per cent in 2016, before stabilising at around 6.2 per cent in 2017.

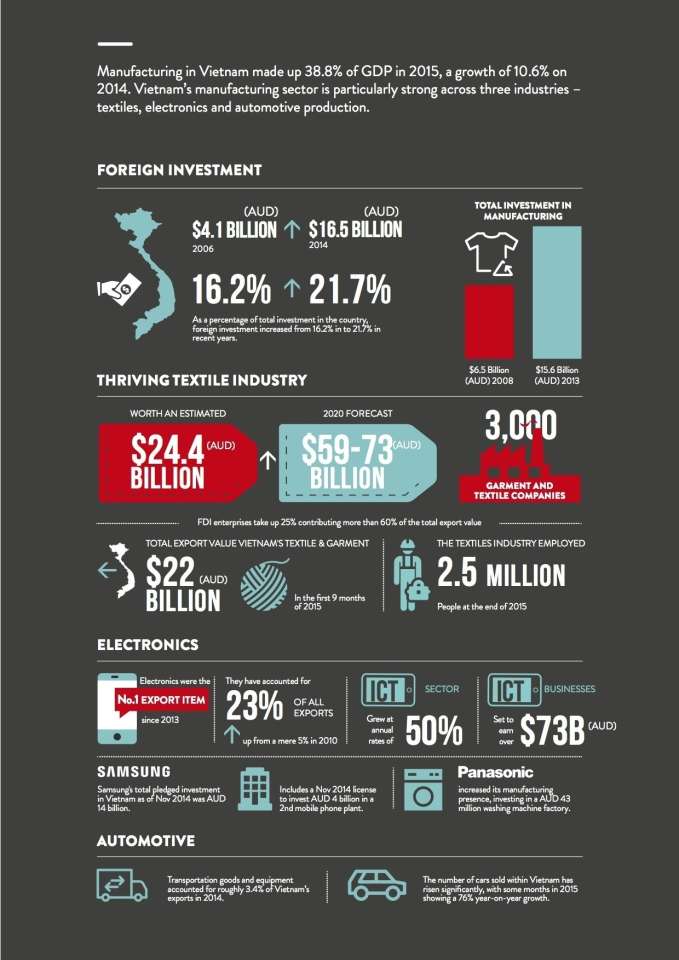

Manufacturing: Vietnam has a growing manufacturing sector accounted for 38.8 per cent of GDP in 2015.

Services: As a developing economy, services account for 43.7 per cent of GDP as of 2015.

Agriculture and primary sector: The agricultural and primary sectors are important contributors to Vietnam's economy, worth 17.4 per cent in 2015.

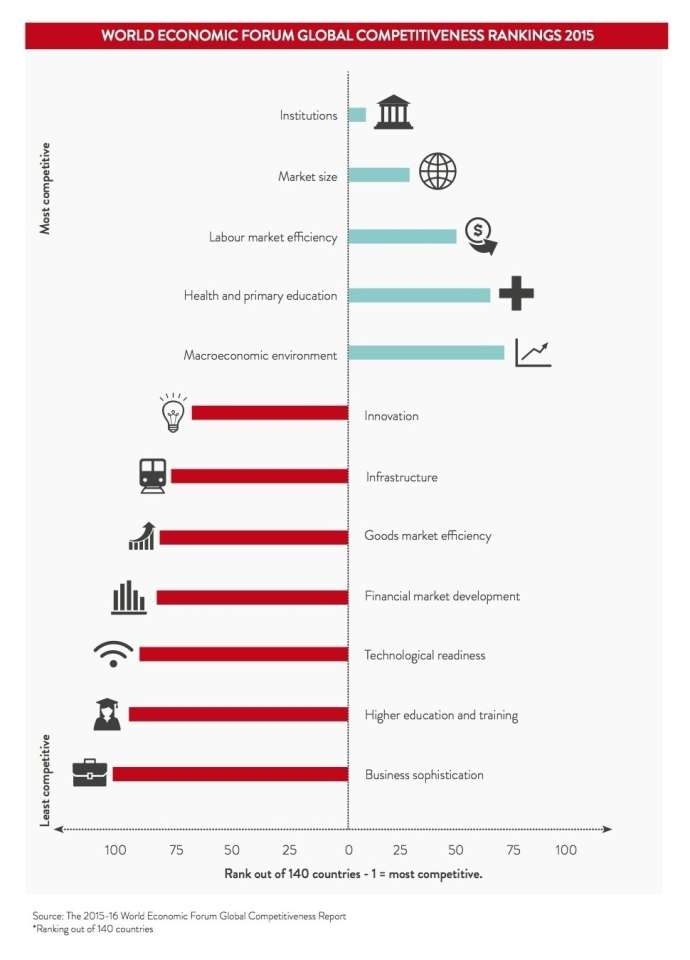

Vietnam lags behind some Southeast Asian countries in terms of infrastructure, despite recent increased investment in transport and communications. It was ranked 76th out of 140 nations on infrastructure in the World Economic Forum's Global Competitiveness report for 2015-2016. By contrast, Malaysia was ranked 24, Thailand 44 and Indonesia 62. Telecommunications infrastructure has improved rapidly in recent years, contributing to a large uptake in mobile phone and internet use.

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

The two countries have profound and indelible links dating back to the Vietnam War. During the turmoil after the war ended in 1975, it opened its doors to thousands of Vietnamese refugees. Since then, Australia has welcomed thousands more Vietnamese under family, skilled migration programs and to study in Australia. Today, more than 200,000 Australians claim Vietnamese ancestry.

On 18 March 2015, the two countries signed a Declaration on Enhancing the Australia-Viet Nam Comprehensive Partnership. The declaration covers regional and international cooperation, trade and investment, industrial development, development assistance, defence, law enforcement and security. It builds on the Australia-Vietnam Comprehensive Partnership signed in 2009 and the bilateral Plan of Action (2010-13).

Vietnam was Australia's fastest-growing export market in Southeast Asia in the 10 years to 2013 (annual growth averaged 16.3 per cent), and this trend continues. Australia's major exports to Vietnam in 2014-15 were:

Australia's major imports from Vietnam in 2014-15 were:

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

There is a range of locations in which to do business in Vietnam, each offering distinct advantages and challenges. Vietnam has seven key geographic regions, with the northeast and northwest often grouped together as the 'Northern Highlands'. There are numerous classifications and divisions for the regions in Vietnam, so different terms may be used elsewhere — such as a 3-region breakdown that is often used in administration and separates the country into North, Central and South. In total, there are 58 provinces and five municipalities that are made up by the smaller classifications of provincial city, districts, and communes. From north to south, the seven regions are: Northern Highlands, Red River Delta, North Central Coast, South Central Coast, Central Highlands, Southeast, Mekong Delta.

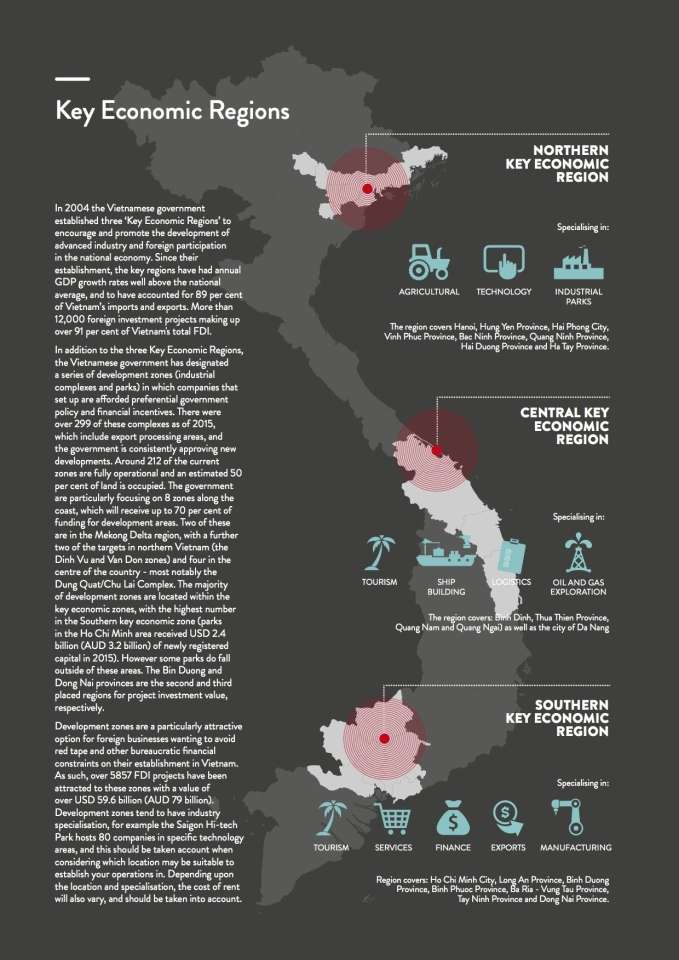

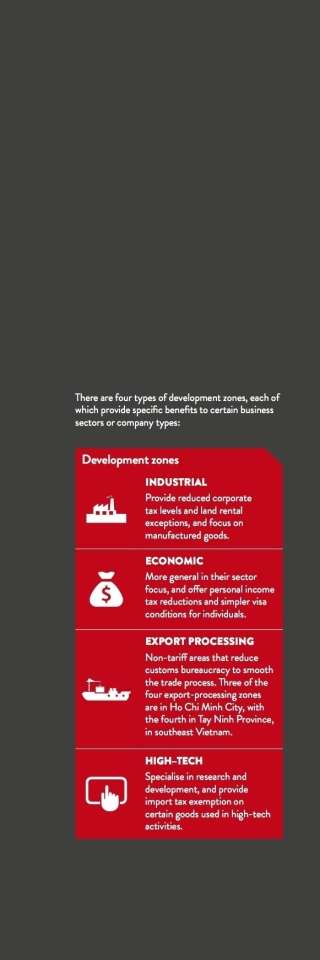

In addition to three 'Key Economic Regions' set up in 2004 to encourage and promote the development of advanced industry and foreign participation in the national economy, Vietnam has designated development zones (industrial complexes and parks) in which companies are afforded preferential policy and financial incentives. There were over 299 of these complexes as of 2015, which include export-processing areas, and the government is consistently approving new developments.

See the full version of the Vietnam Country Starter Pack for more information on specific regions.

Vietnamese is the official language and is spoken across all ethnic groups, although English is spoken widely and understood in business circles, particularly in the major cities. English is increasingly becoming a second language for young Vietnamese. Using an interpreter won't always be necessary, but it can be very helpful during complex negotiations, especially those of a technical nature or when dealing with a large group.

When establishing in Vietnam, you will encounter key differences from Australia in both the costs of setting up and running a business, and in obtaining finance. There are many financing options to consider, and the right choice will turn on variables such as the nature of the proposed business, exporting or importing, setting up from scratch, or investing in an established business. You may wish to gain access to government grants, tap venture capital or enter some type of equity-sharing arrangement. Borrowing from a bank can be the simplest option, and most banks will offer tailored services to business customers.

Venture capital can be attractive. A starting point is the website of Australian Private Equity and Venture Capital Association Limited at: avcal.com.au.

Government assistance information can be sourced from Australia's export credit agency, the Export Finance Insurance Corporation (Efic), at: www.efic.gov.au, as well as the Export Market Development Grants (EMDG) scheme, administered by Austrade, at: www.austrade.gov.au/EMDG. The Hanoi Stock Exchange and the Ho Chi Minh Stock Exchange offer services to companies. See Hanoi at hnx.vn and Ho Chi Minh City at hsx.vn

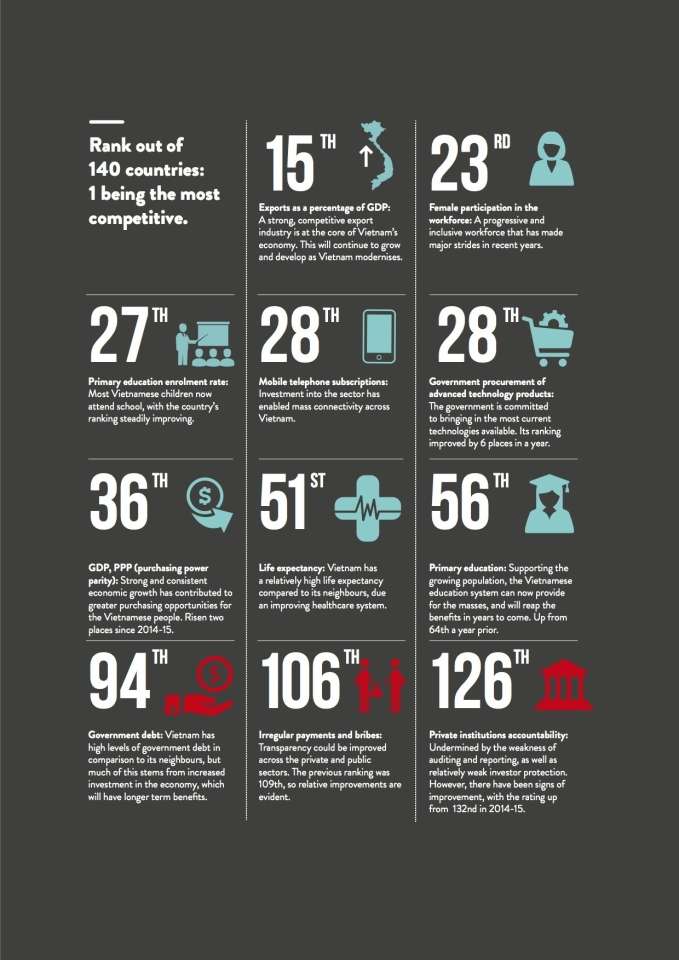

Vietnam's economic outlook is rated as 'stable' by major credit ratings agencies. The country has a BB- credit rating from Standard & Poor's, B1 from Moody's and BB- from Fitch. Its relatively heavy reliance on export markets, however, is seen as a potential source of future risk. The 2015-16 WEF report ranked Vietnam 15th in the world for exports as a percentage of GDP. Vietnam also has a relatively high government debt to GDP ratio (94th out of 140 countries), leaving the macroeconomic environment open to some volatility. Vietnam's capital and monetary frameworks are still emerging alongside developing economic policy.

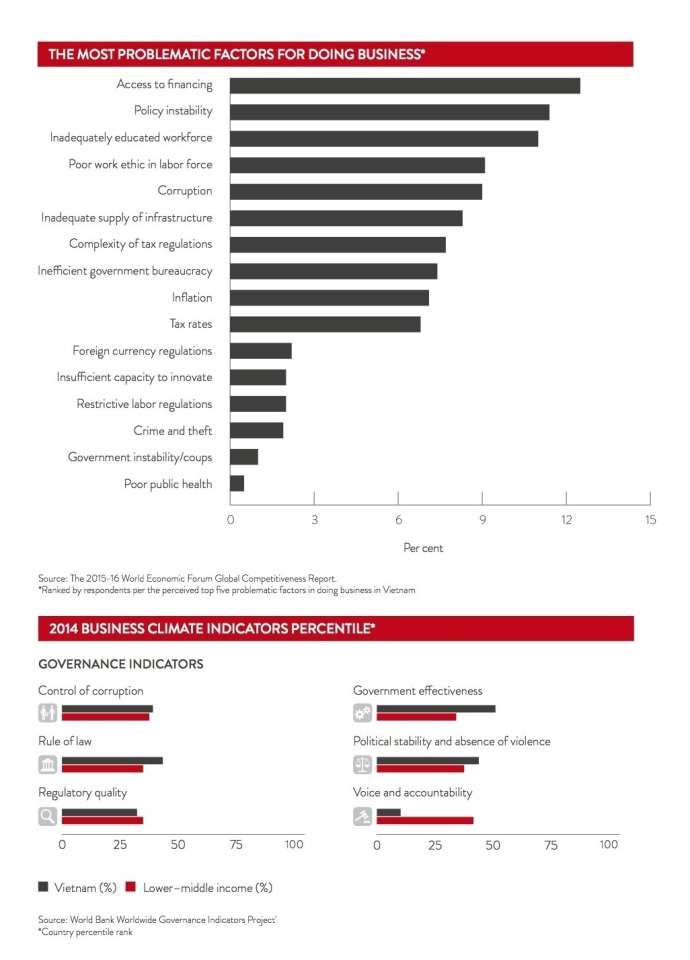

Vietnam's ruling party has in recent years established its generally pro-business credentials. However, Vietnam still has significant problems with public sector corruption. The Transparency International Corruption Index for 2015 rated Vietnam 112th out of 168 countries, better than neighbours Cambodia (150), Myanmar (147) and Laos (139).

Vietnam's legal framework supporting the protection of intellectual property is relatively strong. However, enforcement of IP rights can be an issue, with responsible agencies finding it difficult at times to keep up with rapid changes to the law.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

High-profile international accounting and management firms with a major presence in Vietnam are valuable sources of information.

The Australian Government's Export Market Development Grant (EMDG) scheme can help meet costs, and state and territory governments may provide grants. Austrade offers information and various checklists on:

Ultimately you will need to visit Vietnam to develop a deeper understanding of your target market and make contacts. Visit before striking any binding deals and meet several prospective associates for a basis of comparison. Plan your trip well in advance and arrange in-country assistance.

A good website can be a convenient and powerful calling card that allows potential associates and customers to learn about you and your company quickly and efficiently. Ensure that contact details are clear.

Don't waste time in Vietnam doing what you can do in Australia. Asialink Business, Austrade, the Export Council of Australia (ECA) and various state and territory government departments are useful first ports of call. Attending specialist seminars and courses can build valuable networks while getting expert advice. The Australian Embassy in Vietnam can also provide assistance and direction for businesses, local regulatory and visa issues.

Prearrange as many of your meetings in Vietnam as possible, and reconfirm a day in advance. Take plenty of business cards, share them routinely, and follow up with people who offer you their cards. Send an email within 48 hours thanking your contact for the meeting, and provide any follow-up information.

Joining a business association in Vietnam can be a good way to make contacts and learn more about issues in the local business community. The Australian Chamber of Commerce in Vietnam auschamvn.org is very useful for its network of Australian and Vietnamese businesses in both countries. National bodies in Vietnam such as Invest in Vietnam can be vital points of contact. There are also regional agreements and sister-city relationships between Australian and Vietnamese cities, as well as partnerships between educational establishments.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Once you have decided to set up business in Vietnam, there are many issues to consider. What type of business will you have?

Will it be a joint venture? A Vietnamese registered company? Or will you simply have a branch or representative office?

Although Vietnam is gradually becoming an easier place to do business, it remains one of the more challenging countries in which to start a business, with a ranking of 115 out of 189 nations in the 2016 World Bank Doing Business report.

Vietnam's Law on Investment (LOI) defines foreign investment and foreign businesses. The Law on Enterprises (LOE) specifies company structures that can be used: limited-liability companies, shareholding companies, partnerships and private enterprises. Limited-liability companies and joint-stock companies are the most common. To join a stock exchange or become a public company, a business must be a joint–stock company.

A Limited-liability company: Can be wholly foreign-owned or a joint venture enterprise with at least one Vietnamese investor however cannot issue securities or list on a stock exchange..

A Joint-stock company: Can issue shares and list on stock exchanges under Vietnamese law and can be wholly foreign-owned or a joint venture with at least one Vietnamese investor. There must be at least three shareholders.

Partnership: Between two or more people, making them 'general' partners who have unlimited liability for its operations.

Branches: Not a common form of foreign direct investment and only permitted in a few sectors. Branches are permitted to conduct commercial activities in Vietnam.

Representative offices: Are useful for exploring opportunities however may not conduct direct commercial or revenue generating activities. Representative offices are a very common form of presence in Vietnam.

Business cooperation contracts (BCC): A BCC is an agreement between foreign investors and at least one Vietnamese partner in order to carry out specific business activities. This does not constitute the creation of a new legal entity.

Public and private partnership contracts (PPS): PPS contracts are between government authorities and companies to provide new infrastructure development and public services.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Its low-cost, young and increasingly educated workforce and its strategic location in Southeast Asia make Vietnam a magnet for foreign factories. Incentives have produced a competitive business environment that has lured some of the world's largest and most successful companies. Manufacturing made up 38.8 per cent of GDP in 2015 and will grow as the economy continues to move towards manufacturing and greater technological development. Different regions specialise in varying sectors and industries. The textiles industry thrives across Vietnam, and is worth an estimated USD 17.5 billion (AUD 23.3 billion) per year.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Exporting directly to a foreign market means involving yourself with every aspect of exporting, including:

Advantages of direct exporting include:

While the advantages are clear, going it alone may ultimately involve higher costs in Vietnam through employing in-house staff and other resources to cover every aspect of exports and sales. A potentially lower-cost option is to go directly to retailers in the large consumer markets of Hanoi and Ho Chi Minh City.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Many Australian firms doing business in international markets rely on agents or distributors. It is critical that their roles and responsibilities are clearly defined in any agreement with them. Agents do not take ownership of the products they are trying to sell. Distributors buy the goods from exporters, then resell them to local retailers or direct consumers. Whichever your choice, it is essential to establish a close working relationship with your agent or distributor, and that they have a thorough understanding of the products and prices of your competitors.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

There are 105 direct selling companies in Vietnam and the industry is worth VND 6 trillion. The Vietnam Competition Authority must certify all individuals involved in direct selling activity. Direct selling tends to be an unorthodox mode of market entry, particularly given the ease and market penetration capability offered by online sales. Selling directly means taking charge of all market research and marketing, distribution, shipment, warehousing and delivery, customer and after-sales services, sales order, billing and collection processes — all from Australia, unless you choose to relocate to Vietnam.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Franchising has been growing by around 30 per cent per year in Vietnam, with more than 70 international companies now franchising there and some 100 companies operating overall. Most franchises in Vietnam are fast-food chains. But there is plenty of room for expansion in other sectors. Franchise activities are governed by the Ministry of Industry and Trade (MoIT) and it is advisable to seek expert advice.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Licensing can be a speedy and convenient way to sell intellectual property rights including trademarks, design and patent rights, copyright and software into a foreign market such as Vietnam. It allows rapid market entry with limited limited capital. The Vietnamese Government is a large customer for licences, and as internet penetration continues, opportunities to license digital content will also become prominent.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

The volume of online sales is still modest although Vietnam has seen huge growth in internet uptake. An estimated 35 per cent of the population (around 35 million) now has access. The potential for online selling is enormous.

The value of e-commerce in Vietnam was expected to exceed USD 2 billion (AUD 2.6 billion) in 2016, growing by an average of 17.6 per cent per year until 2020. Marketing is vital in order to establish trust and brand loyalty online. The most popular products sold online include fashion, electronics and home appliances. While global e-commerce sites such as Amazon and eBay are available, local sites such as Tiki.vn, Lazada.vn and Vatgia.com dominate.

More than half of mobile users in Vietnam use their phones for shopping. Instagram has also grown and it now carries advertisements for Vietnamese products.

The majority of payments for goods bought online were still made by cash as recently as 2014. At last count, 64 per cent of online shoppers paid cash on delivery, with credit cards accounting for just seven per cent of sales.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

A useful starting point for your marketing campaign in Vietnam could be an exhibition or trade show to reach out to new consumer bases and potential clients and win insights into the operations of others. Advertising is heavily regulated in Vietnam, with registration required for firms seeking to advertise in the pharmaceutical, agricultural and cosmetics sectors, and limitations on advertising alcohol and tobacco products.

Product and service adaptations: Vietnamese cultural norms should be considered as slight modifications to an already successful foreign product can significantly boost sales. For example, many Western fast food chains produce rice and noodle variations of some of their items to appeal to Asian markets. A notable demographic feature of Vietnam is its youthful population 23.1 per cent of the population in 2014 was under the age of 14.

Your pricing strategy should take into account that average incomes remain relatively low. Australian firms in some sectors enjoy a branding advantage by simple virtue of their products being made in Australia. Hence, an emphasis of Australian origin could be a potential marketing tool, particularly in food and beverage and agricultural sectors.

Cultural considerations: When branding a product, acknowledge cultural symbols that may or may not have positive representations and meanings. In Vietnam, companies should be particularly sensitive to any material that could offend the government or the conservative values of Confucianism.

Advertising and media: Although mobile technologies and internet usage are growing, television and print media advertisements remain a highly trusted marketing source across Southeast Asia to reach the masses. Foreign businesses should consider advertising in both English and Vietnamese. Sales promotions may be an important part of your product strategy, particularly if the target sector is crowded. Direct marketing methods such as text, email, fliers and telemarketing are growing in popularity in Vietnam.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Industry-specific information about labelling can be sourced from the Vietnam Trade Promotion Agency at www.vietrade.gov.vn, and the Vietnamese Ministry of Science and Technology. Packaging should be hardy and able to maintain its integrity in extreme weather conditions. Your distributor should be a good source of advice on this.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Business culture and etiquette in Vietnam draw heavily on Confucianism, with its basic values of order and hierarchy — particularly relating to age and status. Status is mostly determined by someone's formal position and reputation within an organisation, and Vietnamese businesspeople will expect to meet and interact with Australians of equivalent status.

As in many Asian countries, the concept of saving or preserving 'face' is paramount in Vietnamese society and business. Avoid openly criticising or causing embarrassment to individuals. Gift giving is an important part of Vietnamese business culture, and must conform to certain protocols to maintain 'face'.

Beyond issues specific to Asia and Vietnam, most of the usual standards of conduct and behaviour that would be expected in Australia should be applied in Vietnam. Be on time for meetings and confirm appointments or any necessary changes in advance. Follow up meetings with summary emails, and express appreciation for the meeting.

Greetings: The most senior person in a meeting should enter the room first, while the oldest person is often greeted or served first. Handshakes generally take place at the start and completion of a meeting. If somebody does not extend a hand, display a slight bow of the head. When writing, the Vietnamese lead with the family name before middle names and first name. In business, address someone by their title and surname. With government agencies, use people's professional title, such as Chairman Nguyen.

Business cards: Consider having one side of your business card in Vietnamese. Take care with the placement and treatment of business cards to show respect and try to provide all meeting participants with a card, offering it to the most senior person first. Present the card with two hands, and face the writing towards the recipient. Similarly, receive business cards with two hands, read their details before placing them on the table for the duration of the meeting.

Dress code: Dress conservatively. Dark suits with ties for men and conservative suits or blouses or skirts that are longer than knee-length for women. Business dress in the south, and in the hotter months, tends to be less formal.

Dining: Meals usually involve multiple courses, and it is polite to try each. If you have been invited for dinner, you should reciprocate during your stay. Toasts are important rituals. When giving a group toast stand and raise your drink with both hands, and face the most senior Vietnamese member.

Body language: Smiling can convey meanings other than satisfaction and happiness. Vietnamese often smile when they do not understand something, or when they are irritated and nervous. If your Vietnamese counterpart clearly does not understand proceedings, it is best to apologise for your lack of clarity than to point this out — doing so could cause them to lose face.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Business relationships in Vietnam are often initiated by referrals from existing contacts. However, with the increasing use of the internet for business and a more competitive environment, direct contact without prior communication is now more common. They tend to be more social and personal than in Australia, so expect questions not directly related to business. You may be asked about your family and hobbies. Display an interest in Vietnamese culture and language, but avoid religion and politics, death and accidents.

Relationship building can take more time than you might hope or expect, and you should not push too quickly or too hard to initiate business conversations. It is vital to nurture and maintain personal ties with your Vietnamese counterparts between meetings.

Local government and authorities

Some government authorities and business groups you may come across when doing business in Vietnam:

Ministry of Planning and Investment: Controls national-level investment and development schemes and produces the overarching strategies and policies to encourage foreign direct investment - mpi.gov.vn.

Foreign Investment Agency: Administers and manages the foreign investment policies of the Ministry of Planning and Investment - fia.mpi.gov.vn.

Ministry of Industry and Trade: Promotes and directs Vietnamese trade - moit.gov.vn.

Vietnam Trade Promotion Agency: Also called Vietrade, it provides information, opportunities and solutions for foreigners trading with Vietnam. Vietrade conducts research and produces a newsletter on the activities of the Vietnam Trade Office in Australia - vietrade.gov.vn.

Vietnam Chamber of Commerce and Industry: The Chamber, which includes the Vietnam Business Forum, seeks to advance the interests of Vietnamese businesses through conferences, exhibitions, training, and assist foreign firms in Vietnam - vccinews.com.

General Department of Vietnam Customs: Manages imports and exports, and is a useful source of information on matters such as tariffs and regulations - customs.gov.vn.

Ministry of Foreign Affairs: Formulates Vietnamese foreign policy and represents Vietnam abroad - mofa.gov.vn.

State Bank of Vietnam: Sets monetary policy and manages the Vietnamese currency. A useful source for an overview of economic conditions in Vietnam - sbv.gov.vn.

Ministry of Finance: Can assist Australian businesses in clarifying their tax or ownership status in Vietnam - mof.gov.vn.

Ministry of Justice: Responsible for the legal system and can give guidance on laws that may affect business or personal legal rights in Vietnam. Its website is a useful source of information on frequently changing legislation - moj.gov.vn.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Vietnamese will rarely do business with you before they have come to know you face-to-face and established a relationship of trust. You will probably need to meet several times before serious negotiations can begin.

Setting up a business meeting: Send an email stating the purpose of your visit, some key facts about your company, and, if possible, mentioning a personal connection that you have to the company or an individual staff member. Punctuality is critical.

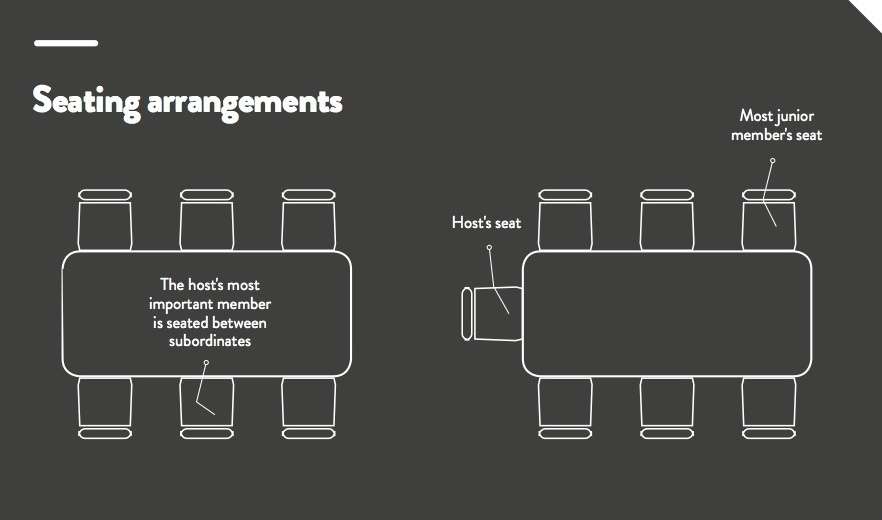

Meeting etiquette: The most common seating arrangement is for the most senior representatives to sit at the centre of the table, opposite one another.

Meeting structure: Meetings are likely to begin with the most senior representatives entering the room, followed by handshakes and the exchange of business cards. The next stage will usually entail small talk, after which the host will make introductory remarks leading to the meeting proper.

Negotiation: Patience is the most important quality you can bring to the table. If immediate decisions are required, send written proposals in advance to give the Vietnamese party sufficient notice and information. Be particularly mindful of the notion of saving face. Vietnamese are highly price-conscious, so demonstrate the value of your product carefully.

After a meeting: Every meeting should be followed up with thanks and acknowledgements to your Vietnamese counterparts for their time and consideration.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

It is essential to conduct thorough background checks on prospective foreign business partners and others with whom you may be dealing. Different degrees and methods of due diligence may be applicable for different situations, and it is advisable to seek appropriate professional advice. There are many reputable accounting and legal firms in Vietnam that can assist in this.

Dispute resolution: In the event of a commercial dispute in Vietnam, it is essential to seek professional legal advice in Australia and/or in Vietnam. Austrade can identify appropriate law firms in Vietnam.

Arbitration and mediation: The Vietnam International Arbitration Centre ( eng.viac.vn) promotes alternative dispute resolution without resorting to a court.

Scams: Vietnam has its share of fraud and scam artists. Several websites document scams operating in Australia and abroad. Scam 'alerts' are available at: scamwatch.com.au.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

The Law on Investments (LOI) details the rules and regulations for foreign investment into Vietnam.

Restrictions and prohibitions on foreign investment

Unlike many countries in Asia, Vietnam does not a negative list detailing which industries are no-go zones for foreign investment. Defence and sectors directly related to national security are off-limits to foreign investors. Foreign investment in the following areas requires prime ministerial approval:

Vietnam offers a number of corporate income tax (CIT) concessions to encourage investment in certain regions and sectors. The Foreign Investment Agency, which plays a key role in promoting and facilitating investment in Vietnam, is a good source of information.

Under Vietnam's Constitution, all land is collectively the property of all the people. As such, no one, Vietnamese or foreign, is permitted to 'own' land as such. Instead, the right to use land is obtained in several ways. A 'Certificate of Land Use Right, House Ownership and Other Assets attached to Land', or a land use rights certificate, proves that someone has land use rights and ownership of assets on it.

The two principal laws governing the protection of intellectual property rights in Vietnam are the Civil Code and the Law on Intellectual Property. The IP system is administered by the National Office of Intellectual Property, the Copyright Office of Vietnam, and the Plant Variety Protection Office.

Trademarks are granted on a 'first-to-file' basis. Rights to use a trademark established by registering a trademark first and meeting certain criteria.

Three types of patent are available in Vietnam. Copyright automatically arises when an original work is produced. New plant varieties can be registered and protected for up to 25 years.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

When exporting to Vietnam, Australian businesses need to be aware of import regulations and tariffs and duties that may apply to their goods. These regulations are frequently revised, so you should reconfirm your situation before exporting to Vietnam.

To protect domestic distribution enterprises, retail distribution by foreign businesses in Vietnam is still restricted and subject to an approval process based on an Economic Needs Test.

Import duty rates are in three categories: ordinary rates, preferential rates and special preferential rates applicable to imported goods from countries that have Most Favoured Nation. Australian goods enjoy special preferential rates through the ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA). To find the tariff rate for specific goods, visit the AANZFTA Tariff Finder maintained by Austrade at: aseantariffs.austrade.gov.au/tariff-finder/. The Customs Department of Vietnam is responsible for levying tariffs on imported goods. For up-to-date information visit: customs.gov.vn.

In principle, Vietnam follows the WTO Valuation Agreement on imported goods with certain variations. Specific Sales Tax (SST) applies to some products in addition to import duties. Value Added Tax will also be applied (unless exempt under the VAT regulations).

Import duty exemptions are provided for projects involving 'encouraged sectors' and for goods imported in certain circumstances. There are 20 categories of import duty exemption. In some instances, refund of import duties is possible.

Export duties are charged only on a few items — mainly natural resources such as sand, chalk, marble, granite, ore, crude oil, forest products plus scrap metal.

The Ministry of Industry and Trade issues regulations, usually in the form of 'circulars' that provide the legal basis for what can or cannot be imported or exported. Among prohibited imports/exports are weapons, ammunition, and (non-industrial) explosives. Goods imported or exported across Vietnam's borders need the correct paperwork or risk delays or fines.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Vietnam imposes a wide-ranging tax regime on businesses and individuals that incorporates income taxes (corporate and personal), turnover and indirect taxes (VAT and specific business tax), as well as property tax, stamp duty, excise, customs duties and municipal taxes.

The print and online versions of the Vietnam Country Starter Pack provide an overview of the primary taxes Australian enterprises need to consider, but professional advice from firms operating in Vietnam is vital for understanding tax rules specific to your business.

Tax year and tax returns: In Vietnam, the tax year is the same as a calendar year. Tax returns need to be filed within 90 days of the end of the tax year.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Accounting records generally must be maintained in the local currency, Vietnamese dong. Foreign-invested business entities can select a foreign currency for their accounting records and financial statements, provided they meet all stipulated requirements. Accounting records must be maintained in Vietnamese, but this can be combined with a commonly used foreign language such as English. At the end of a financial year, the entity must perform a physical count of its fixed assets, cash and inventory.

Companies operating in Vietnam must comply with the Vietnam Accounting System. It is possible to diverge from the standard VAS, but this is subject approval from the Ministry of Finance. Tax authorities treat VAS non-compliance as a basis for tax reassessment and imposition of penalties, including withdrawal of CIT incentives, disallowance of expense deductions for CIT purposes and disallowance of input VAT credits/refunds.

An independent auditing company operating in Vietnam must audit the annual financial statements of all foreign-invested business entities. They must be completed within 90 days of the end of the financial year.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Vietnam has near full employment, with an unemployment rate hovering around two per cent in recent years. With a young and growing population, the workforce of over 54 million will continue to expand. As a result, the availability of labour is a key attraction of doing business in Vietnam. The skill level is increasing, thanks to greater secondary education completion. However, skills shortages persist in some areas.

The Labour Law, updated in 2013, sets out safeguards, employee entitlements and responsibilities.

Working hours: The normal working week can be up to 48 hours. In practice, the normal working week comprises five eight-hour days, totalling 40 hours.

Leave: Workers employed for more than 12 months are entitled to 12 days of paid leave. For every five years of service this entitlement increases by one day. All employees are entitled to all 10 paid national holidays.

Overtime: Overtime is limited to 200 hours per year, or up to 300 hours under special circumstances. Total hours must not exceed 12 hours in one day. Employees have the right to refuse overtime.

Minimum wage: It rose to VND 3.5 million (AUD$215) per month in 2016 in the most developed areas of Vietnam. Skilled workers must be paid at least seven per cent more than the regional minimum wage. Wages generally are still significantly lower than in comparable regional.

Sick leave: Entitlements are determined by how long workers have been contributing to the social insurance fund.

Social, health and unemployment insurance contributions: Social insurance (SI) and unemployment insurance (UI) contributions apply to Vietnamese individuals only. Health insurance (HI) contributions are required for both Vietnamese and foreign individuals employed under Vietnam labour contracts.

Termination of employment: Employees enjoy extensive protection, which can make unilateral termination difficult. Unilateral termination is allowed if at least one of the five conditions is met. In certain instances, severance pay must be provided.

Work permits for foreigners in Vietnam are issued by the Department of Labour. Permits are valid for three years, and can be renewed on application. If you have a work permit that is valid for at least one year, you can apply for a Temporary Residential Card, valid from one to five years. Expatriates with a card can enter and exit Vietnam without a visa.

To ensure successful cross-cultural management in Vietnam, people must be treated with respect and deference at all times. Public criticism or displaying anger causes a loss of face and may jeopardise future relationships. In Vietnam, as in other hierarchical societies, managers may adopt a somewhat paternalistic attitude towards their employees.

Timelines and priorities: The Vietnamese sometimes have a relaxed attitude towards schedules and timelines. Patience is a necessary attribute for successful cross-cultural management.

Decision making: Vietnam is a hierarchical culture, with most decisions made at the top, then implemented by employees. There may be informal networking, but a few key people generally hold actual power.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Generally, foreign companies in Vietnam will need to open a bank account in order to conduct their business. The banking sector includes domestic commercial banks, state-owned commercial banks, 100 per cent foreign-owned subsidiary banks, foreign bank branches and cooperative banks.

To open a bank account in Vietnam, you will need to present your passport as proof of identity. If you have a business in Vietnam, the business certificate will be required.

Australian banks in Vietnam: ANZ operates as a wholly foreign-owned bank, ANZ Vietnam. Commonwealth Bank has a branch in Ho Chi Minh City and a representative office in Hanoi. NAB has a representative office in Hanoi.

Foreign exchange control: The VND is not freely convertible and cannot be remitted overseas. As a general rule, all monetary transactions in Vietnam must be undertaken in VND.

Foreign-invested enterprises may, subject to certain conditions, buy foreign currency from banks to make foreign currency payments overseas. Foreign enterprises and foreigners in Vietnam are permitted to transfer abroad profits and income earned in Vietnam, and any remaining invested capital at the end of an investment project.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Foreign investors are permitted to remit their profits annually at the end of the financial year or upon termination of the investment in Vietnam. Foreign investors are not permitted to remit profits if the investee company has accumulated losses.

The foreign investor or the investee company must notify the tax authorities of the plan to remit profits at least seven working days prior to the scheduled remittance.

Choosing the right payment option: Payment terms can prove decisive when competing for business, and savvy negotiators will often use such detail as leverage for clinching a deal. It is worth erring on the side of caution in your initial business transactions by using secure methods of payment, such as letters of credit. The default currency for payment, quotes and invoices — if not VND — is US dollars.

Risks of non-payment: Risks of default on payments are best managed by choosing some form of pre-payment or documentary credit. Some independent assessment of the buyer with the help of your bank or an international business consultant may be worthwhile.

Managing exchange risk: Should be discussed with your professional adviser and bank. Bank websites usually outline key information regarding exchange rate products.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

To enter Vietnam, your passport must be valid for at least six months following the date of arrival. You must also hold a valid visa, a visa exemption document, or an approval letter for a visa on arrival. Since 2015, foreigners have no longer been able to change the status of their visa after entering Vietnam, and must use only one passport for entry to and exit from Vietnam. For more information go to: visa.mofa.gov.vn/.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

The Vietnamese dong (VND) is the official currency of Vietnam, though US dollars (USD) are also widely used. Notes are available ranging from VND 500,000 down to VND 100. Coins are used for VND 5,000 downwards, other than VND 100. While the use of credit and debit cards is growing and ATMs are increasingly available, they can be difficult to find, especially in rural areas. Visitors should exercise caution when changing money in Vietnam. The high denominations of the dong can make exchanges confusing.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Most Australians enter Vietnam through one of two major airports: Tan Son Nhat International Airport in Ho Chi Minh City or Noi Bai International Airport in Hanoi.

Tan Son Nhat International Airport is just six kilometres from the centre of Ho Chi Minh City. Travel into the city centre is easiest by taxi. It is advisable to use metered and official taxis only, and always ask for the meter to be switched on when starting the journey.

Noi Bai International Airport is 45 kilometres from central Hanoi and taxis are the easiest way to reach it. Alternatively, minibuses run to and from the Vietnam Airlines office in the city centre. Public buses 7 and 17 also connect to the city.

Among other international airports, the most significant is Da Nang, which serves routes to regional hubs such as Singapore, Kuala Lumpur and Seoul. There is also an extensive domestic passenger air network.

Australian mobiles should work straight off the plane, provided your Australian contract allows for international use. However, beware of very high charges if you have not purchased an international roaming package from your Australian telco. Alternatively, buy a pre-paid SIM card from one of Vietnam's three major telco network operators: Mobilefone, Vinaphone and Viettel.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Taxis are generally safe and cheap in Vietnam. However, there can be pitfalls for foreigners, including taxi scams. Always ask for a receipt with the driver's personal licence details. Best is to travel only with reputable taxis such as Vinasun and Mai Linh. Cyclos and rickshaws remain common, and overcharging is rampant. Have a clearly agreed price and pay by the journey, not per passenger.

Australian driving permits are not recognised in Vietnam, and non-Vietnamese citizens are only allowed to drive if they hold a valid temporary Vietnamese driver's licence. Valid licences are required to ride a motorbike of 50cc or greater. A good flexible option is to hire a rental car with a driver. Vietnam has a high rate of accidents and major cities have significant congestion.

Vietnam has an extensive rail network, with the Hanoi-Ho Chi Minh City 'Reunification Express' route a key transport artery. The rail network covers most regional cities, and trains have multiple class options. Book tickets up to 90 days in advance on http://dsvn.vn/#/ or through many agents internationally. Schedules change regularly, so confirm travel plans before and on your day of travel. The network's website ( vr.com.vn/en) is a useful resource for information on specific journeys.

Petty crime is an issue on sleeper trains and on public transport in general. When sleeping, keep valuables close to you and tie your bag to you.

Buses serve both local routes within cities and regional routes across the country. Major cities all have multiple bus stations. 'Open tour' buses cater for tourists and allow for multiple stopovers on long journeys. A ticket from Ho Chi Minh City to Hanoi should cost between USD 30 (AUD 40) and USD 75 (AUD 100). The Sinh tourist and Mai Linh Express are popular and reputable providers.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Hanoi has a large variety of accommodation options to suit all tastes and budgets. One of the most convenient and popular areas is the Old Quarter, part of the Hoan Kiem district, which is also Hanoi's central business district. The Cathedral District is popular with travellers. Many global hotel chains are represented in Hanoi.

Ho Chi Minh City also has the full range of accommodation options. The city is divided into 24 districts, with Districts 1 and 3 the most popular areas in which to stay. District 1 is the most modern and central part of Ho Chi Minh City and is both the commercial and financial centre. Most of the city's five-star hotels are in District 1. Districts 2 and 3 are not far away, and are slightly cheaper. District 2 follows the bends of the Saigon River and offers a high standard of living for resident expatriates.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Australian travellers should consult smarttraveller.gov.au regularly. Registration with DFAT is recommended before making a journey.

Australians are strongly advised to take out comprehensive health insurance cover. Before heading to Vietnam, you should research your vaccination options, some of which may require multiple visits to the doctor starting at least eight weeks before departure. Vietnam requires evidence of vaccination against Yellow Fever for people coming from a risk area.

Health services in Vietnam are not as good as in Australia, and they operate differently. The great majority are public, although the private sector is expanding quickly.

There are multiple health risks to consider in Vietnam. They include air pollution, tap water, food-borne and water-borne and other infectious diseases, malaria and other mosquito-borne illnesses, hand, foot and mouth disease. Travellers should avoid interacting with animals and seek immediate help if bitten.

Vietnam is prone to tropical cyclones between May and November, particularly on the east coast. Travellers should check potentially threatening weather systems and be aware of local evacuation and emergency procedures.

Vietnam is generally very safe for Australian travellers. Most crime is petty and physical attacks are rare, though not unheard of. Pickpocketing and snatch-and-grab offences are the most common crimes. Pay attention to belongings at all times. Protests and civil unrest are rare. If you encounter a demonstration, stay away and do not take photographs.

Useful numbers for emergencies include:

Drug possession and trafficking attract harsh penalties, including the death penalty and life in prison. A number of Australians are currently serving long sentences in Vietnam for such offences. Crimes such as sexual assault and fraud attract long prison sentences, while the death penalty has been applied to serious crimes such as rape and hijacking.

An activity that may not be criminal elsewhere can attract long sentences in Vietnam. For example, gambling outside state-sanctioned casinos is illegal, as is possession of pornography and non-state sanctioned political and religious material. Under the Vietnamese legal system, one can be detained for an unlimited period without charge. Australian nationals abroad remain subject to prosecution back in Australia for child sexual exploitation, bribery, money laundering, terrorism, and others offences.

Vietnam recognises dual nationality only in some cases. Dual nationals should travel on Australian passports.

For more information, access the full Vietnam Country Starter Pack

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

Asialink Business provides high-calibre opportunities for Australian businesses to build the Asia capability of their executives and team members. Our business-focused cultural competency programs, professional development opportunities and practical research products allow businesses to develop essential knowledge of contemporary Asian markets, business environments, cultures and political landscapes.

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

This app requires Google Chrome to continue. Tap the icon, copy link, then paste into Chrome

This app requires Google Chrome to continue. Tap the icon, Open in browser, then choose Chrome

Vietnam CSP

| App category: | Other |

| Updated: | September 19, 2019 |

| App Publisher: | Asialink Business |

| Compatible with: | iOS 6+, Android 4+, Blackberry 10+ and Windows Phone 8+. |

| Legals: | Terms of use |

You successfully shared the app

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?

You successfully shared the app

https://vietnamcsp.shareableapps.com/

Tap and hold link above to copy to clipboard.

Are you sure you want to delete this message?